New IRS Tax Audit Rules for Partnerships (including LLCs taxed as partnerships)

- - By : contentmaster

- Date : 13-Feb-19

February 11, 2019

IRS Tax Audit Rules for Partnerships (including LLCs taxed as partnerships)

The Bipartisan Budget Act of 2015 (“Act”) made significant changes to the Internal Revenue Service’s partnership audit rules effective for partnership tax years beginning in 2018. How the new audit rules will affect a partnership and its partners will depend, in large part, on choices the partnership, the partnership representative, and/or the partners make or fail to make. The changes are expected to dramatically increase the audit rates for partnerships and will require partners to carefully review, if not revise, their partnership’s operating agreement.

Careful planning today will help mitigate any unfavorable consequence.

Important new provisions that may impact you:

• The IRS may collect any additional tax, interest, and penalty directly from the partnership rather than from the

partners (the tax could be collected at the highest individual tax rate).

• Current partners could be responsible for tax liabilities of prior partners.

• New elections and opt-outs will be available and your agreement may need revision to specify who makes these decisions.

• There are many new tax terms and concepts that will likely require you to adjust your partnership’s operating agreement.

New Partnership Representative Role

Under the new rules, the designated partnership representative has the “sole and exclusive authority” to act on behalf of the partnership and to bind all partners with respect to partnership matters subject to the partnership audit rules. This authority includes, but is not limited to, making relevant elections, representing the partnership during an audit, negotiating and agreeing (or disagreeing) to settle with the IRS, and seeking judicial review of an IRS adjustment. In the absence of an appointed person, the IRS has the discretion to pick a partnership representative; therefore, partnership and LLC agreements should be revised to specify who will act as the partnership representative.

Available options for Partnerships to “elect out” of the new audit rules

Small partnerships (100 or fewer eligible partners) may choose to “opt out” of the new partnership audit rules by making an annual election on a timely filed Form 1065 for the applicable tax year. The option to “opt out” of a partnership level audit is not available to any partnership that has trusts or partnerships (including LLCs taxed as partnerships) as partners.

Another option, the “push out” election, is available to partnerships once a notice of final partnership adjustment is issued. The partnership would need to make a timely election within 45 days of receiving a notice of final partnership adjustment to “push out” the assessment to the individuals that were partners during the audited tax year. This election comes at a cost. The rate of interest assessed on underpaid taxes rises two percentage points if this election is utilized; however, the increased interest rate may be acceptable if the current ownership is different than the year audited.

Under the options detailed above, the partnership would pass through the tax adjustment to the persons who were partners during the audited tax year by issuing amended Schedules K-1. Each partner receiving an amended Schedule K-1 would be required to amend their returns for the audited tax year.

Items requiring your attention:

• Discuss this information with your fellow partners/members;

• Choose a Partnership Representative;

• Contact your lawyer to update the partnership agreement and/or LLC operating agreement, as needed;

• Once the partnership agreement has been updated, have your lawyer provide us a complete copy of the partnership / LLC

agreement including all amendments, thereto.

Please call us if you would like to discuss these new partnership changes and review your planning opportunities.

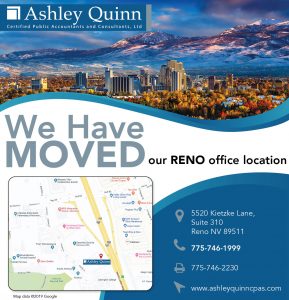

OUR RENO OFFICE HAS MOVED!

- - By : contentmaster

- Date : 10-Feb-19

2025 UPDATE — We moved again!

Click for details, we’re now at 540 W. Plumb Lane, Suite 110.

Original post from our move in 2019:We are now open in our new South Reno location, just south of the Kietzke Lane and Neil Road roundabout. If you are in the area, please stop by to say hello!